If you haven't read my post about my departure from YNAB, you can view it here: Sorry YNAB, I'm moving on

I don't know much about the people behind Buckets other than the designer Matt has been inundated with new users ever since YNAB announced their sudden price increase. I was also someone that decided to look elsewhere and when I saw that YNAB will refund any unused months from a yearly subscription purchase, I thought it really was time to see what YANB alternatives were out there. I stumbled upon Buckets after seeing it mentioned on a Reddit thread. It looks and behaves similarly to YNAB albeit on a lower budget so understandably it isn't as fleshed out and "feature-rich" as YNAB. I'm sure with time it will evolve and grow so it's a perfect time to jump in and see what it has to offer.

Matt shared his data on downloads with the Buckets reddit community which shows to increase number of downloads after YNAB announced it's sudden price increase - unfortunately, it doesn't have the axes labelled but it clearly shows the sudden, dramatic increase:

What is Buckets?

Buckets is a 'YNAB alternative' that prides itself on not shackling its users to "yet another monthly service" and instead allows you to try out Buckets with all the features for an unlimited amount of time. It has a one time fee of $49 which you can pay whenever you feel ready and confident that Buckets is the right fit for your budgeting requirements.

Edit: Since I wrote the above paragraph, Buckets has launched "Buckets by the Loaf" which offers an affordable price for everyone that wishes to purchase a license. It works by understanding that in certain countries with a high cost of living, a Buckets license costs more than an entire month's salary. To counteract this, you can fill in a form to get a discounted rate equivalent to around 20 loaves of bread. There's a blog post explaining this here and here.

Moving from YNAB to Buckets

Once installed, I have set up a new budget and saved the .bucket file onto OneDrive so I can access my budget on my PC or laptop easily. The developer is currently working on a nYNAB importer which has a few bugs but the beta I have used has worked well which means that I have all my historical nYNAB data now in Buckets! There was a few steps I had to be aware of and do in a certain order. The main issue I had was surrounding credit cards. Credit cards work the same way in Buckets as they do in nYNAB and found that the below process worked in order to get them behaving correctly:

Firstly, I had to make sure that I had no pending transactions in nYNAB (specifically on credit cards) as this seemed to have caused a double negative count if I cleared them in Buckets after. I marked them as cleared, and THEN did the export.

- After import, I changed the account type on my credit cards to “debt” (in order to get the special credit card bucket created by the software)

- Removed any money already set aside in my original CC categories ported over during the import (this puts it in the make rain fund)

- Assigned the amounts to the newly created special buckets

- Deleted the original bucket/categories that were ported over.

After the import, correctly identify credit card accounts as “debt” before looking at the “make it rain” amount. Do the same thing for any accounts that should be "off budget" (known as "Tracking" accounts in nYNAB). It should zero out after changing the credit card accounts to “debt”.

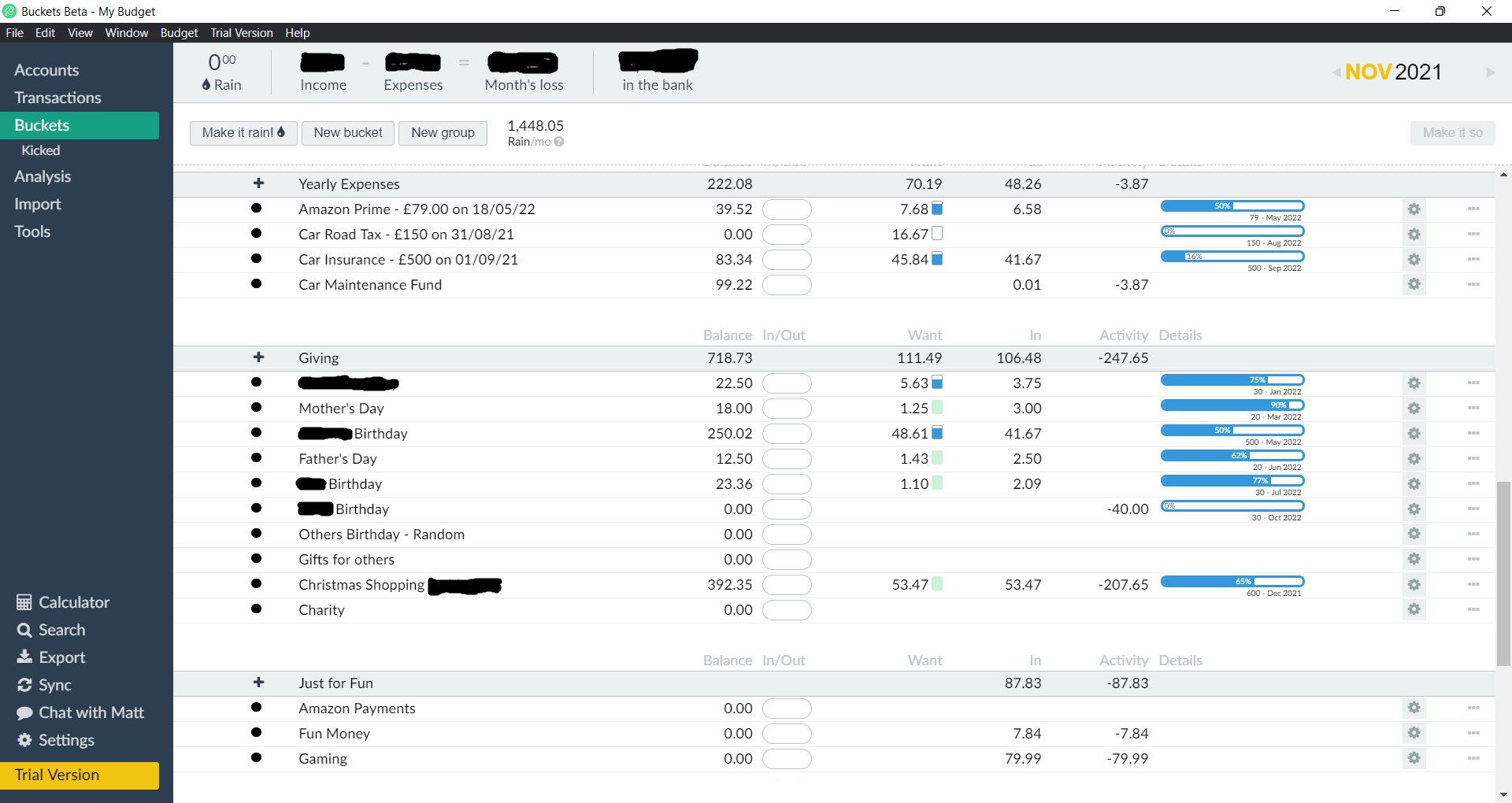

I then went through and assigned buckets with a goal where appropriate. They work much in the same way as nYNAB and Buckets comes with a handy guide on this which can be seen here.

How does it compare?

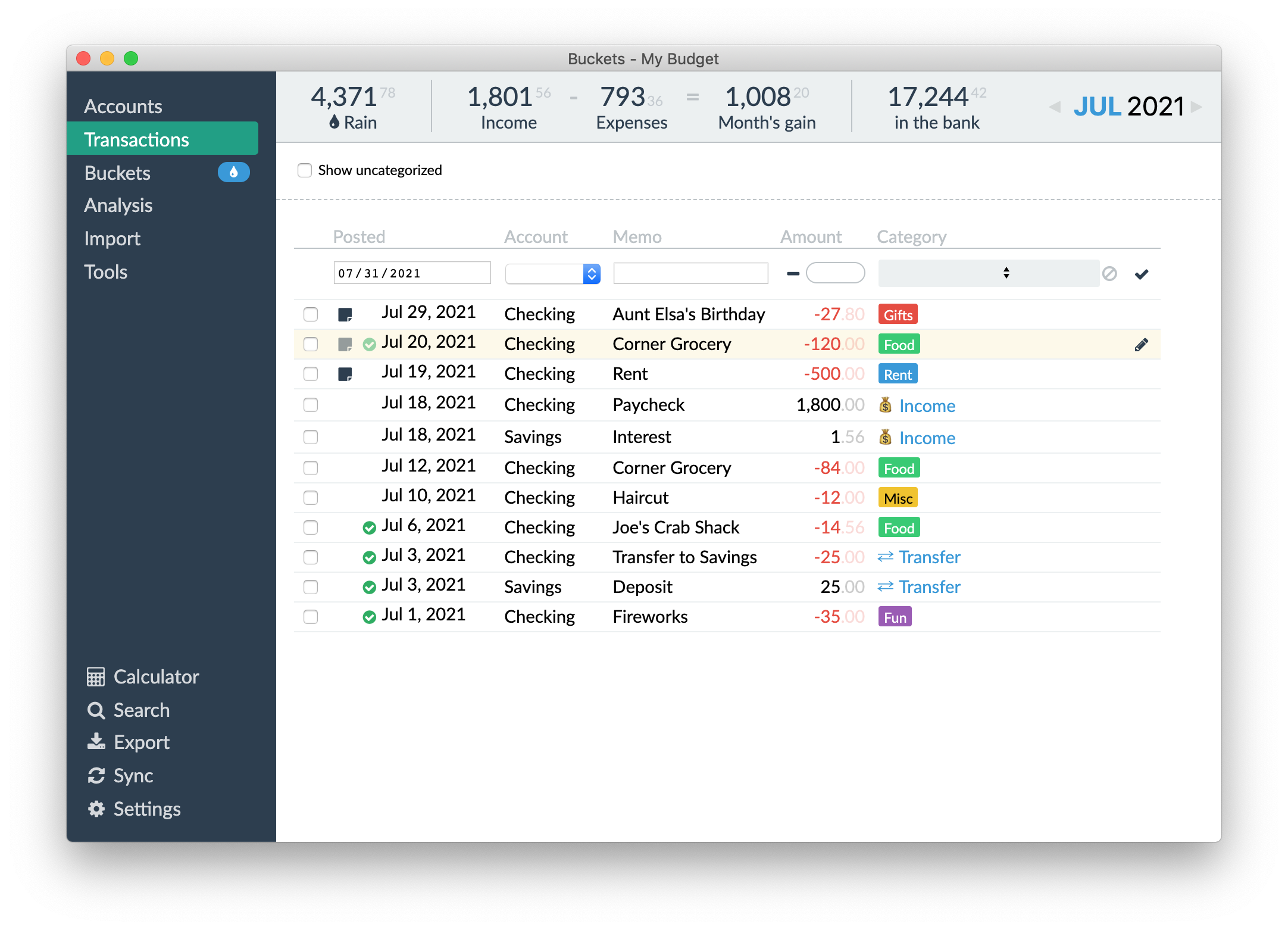

From there, I simply used Buckets much in the same way that I was used to in YNAB. I have always added all my transactions manually every couple of days so it's no more work that I am already used to. I've always found that doing it this way makes me more in tune with my spending and I always know where I am financially in the day to day. In the first few weeks, I did notice that it is easy to 'mis-budget' and end up with some wonky numbers in prior months, however I think it was more teething problems whilst learning the program. I would like to see some indicator in the top banner if there's any issues with a prior or future month though.

Spending goals

If you're one that likes to use spending goals, Buckets includes the main target types similar to YNAB. They are: Recurring expense, Save X by Y date, Save X by depositing Z/mo, and Save Z/mo until Y date. These four should provide most use cases for various types of targets and when you apply one of these by changing to it from a "plain old bucket", you will see the target graphs on the right-hand side of each bucket.

- Recurring Expense: For this type of bucket, you specify how much to put in it every month.

- Save X by Y date: Use this bucket if you know how much money you’ll need for something at a certain point in the future. You enter the target amount and date and Buckets computes how much you should add per month.

- Save X by depositing Z/mo: Choose a target amount you want saved and how much you can afford per month and Buckets will compute when you’ll reach your goal.

- Save Z/mo until Y date: Choose a target date and how much you can afford per month and Buckets will compute how much you’ll end up with by the date.

There's also a nifty feature where you can split one transaction over multiple buckets. For example, if you have done shopping at a superstore and bought groceries as well as some clothes, you can now split this transaction into the respective buckets:

Analysis & insights

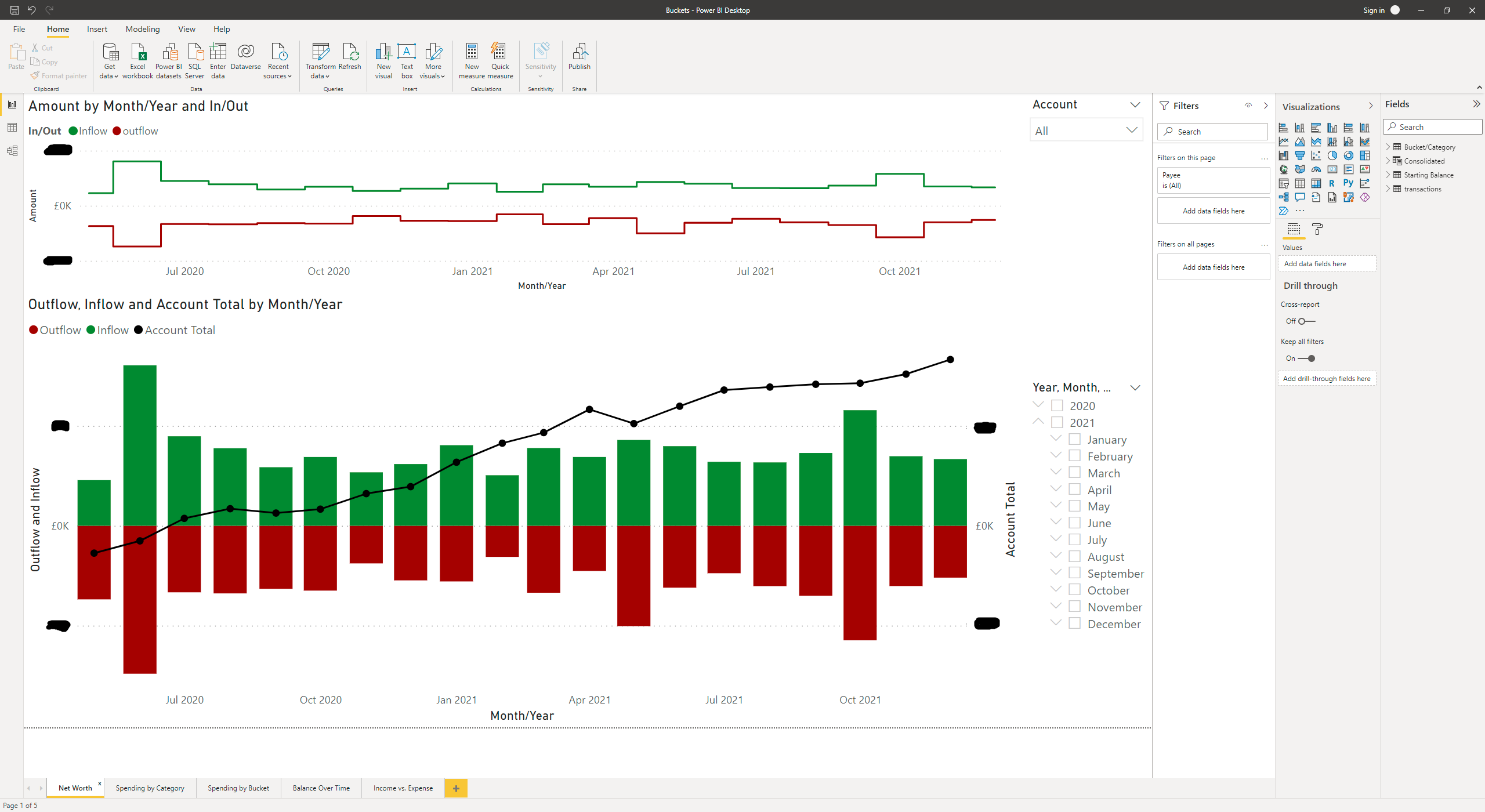

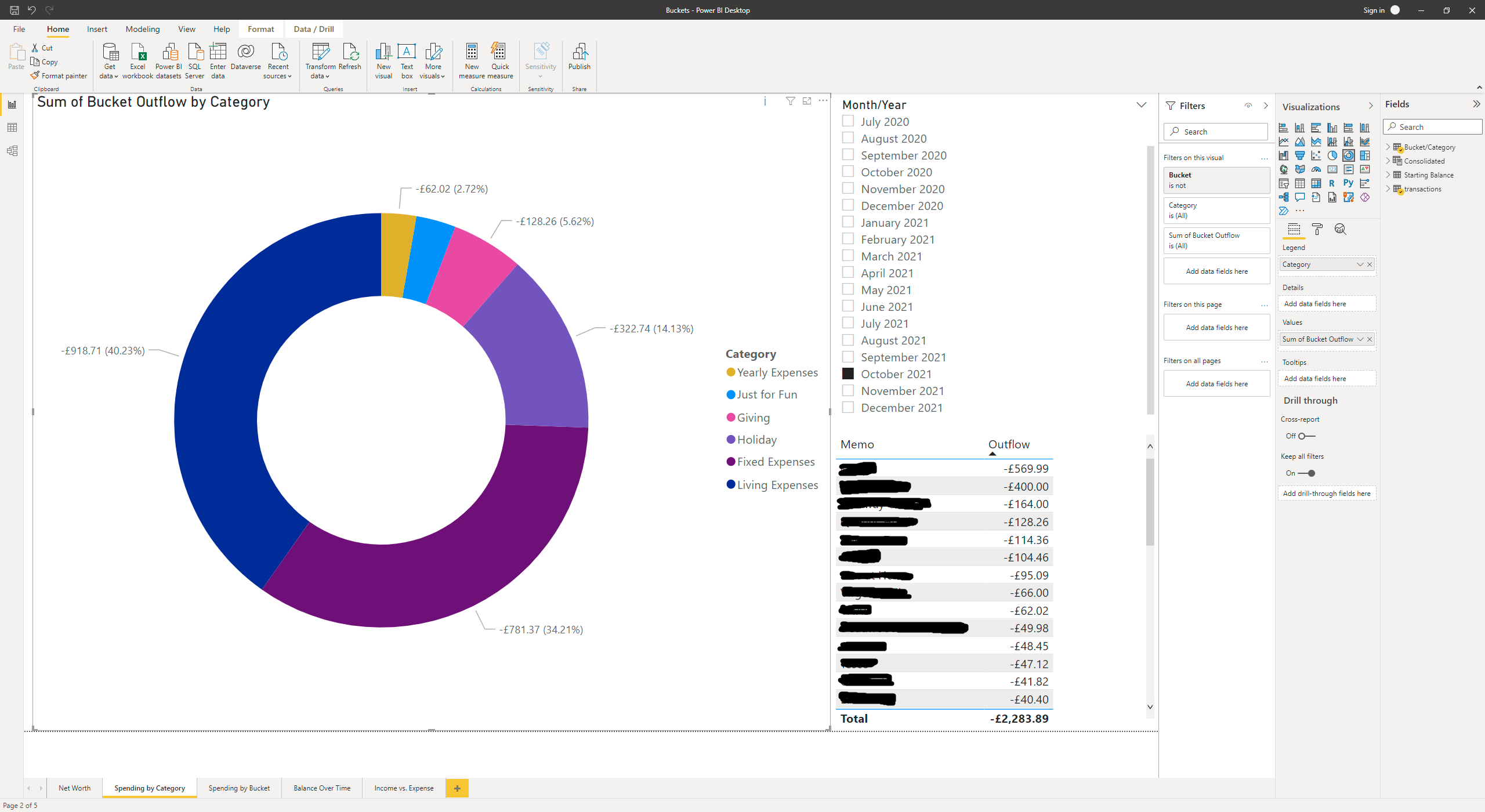

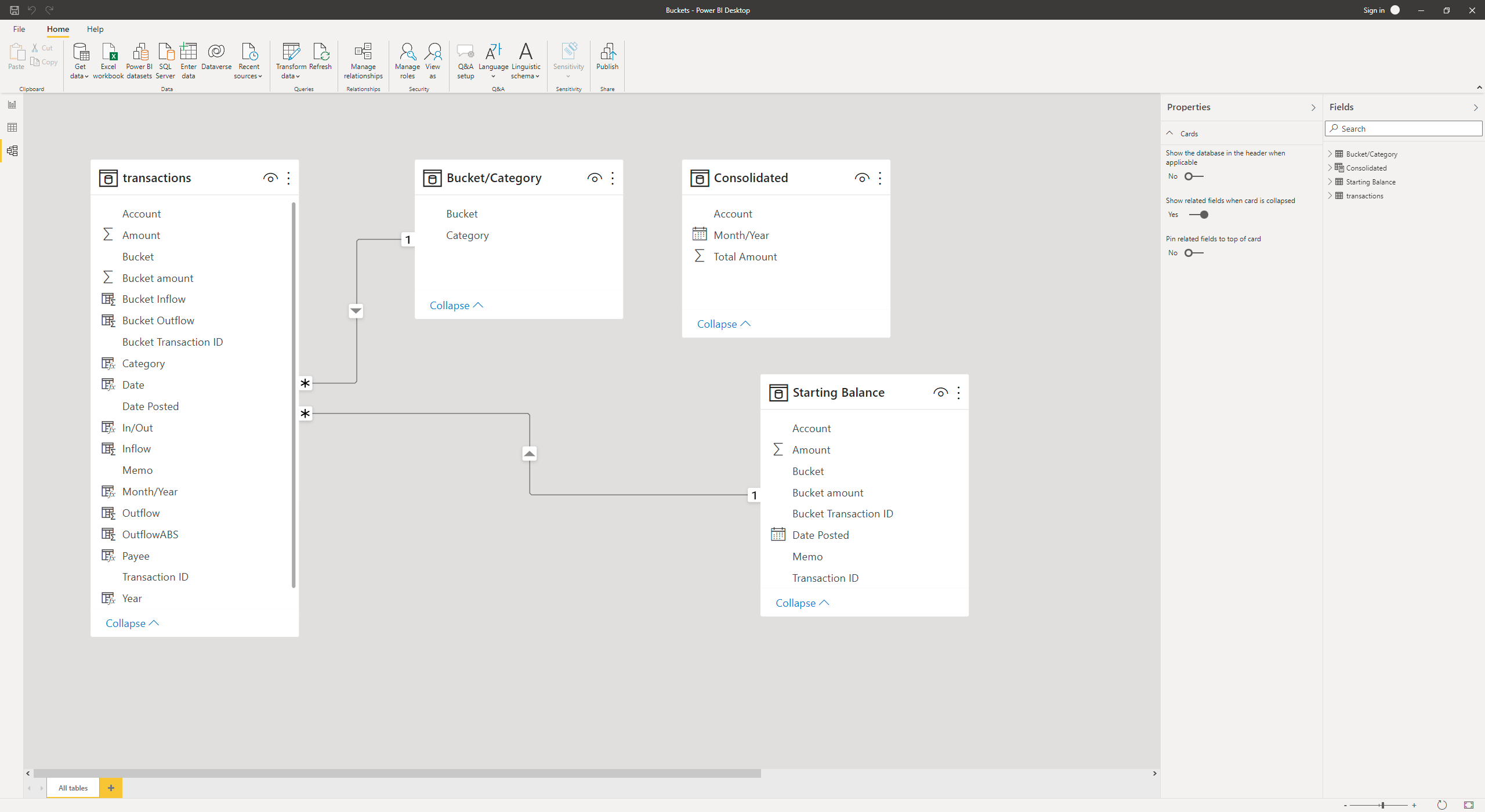

The thing that's missing from Buckets is the in-depth analysis side financials. YNAB when coupled with YNAB Toolkit was a power tool to dig into spending behaviours, to reflect on prior months, and to see how your net worth is growing over time. In Buckets, there's an analysis section but currently it is very minimal. The graphs it does show aren't obvious as to what they are trying to convey - it's simply not as easy to gain insights. The other issue, is that the data analysis here isn't dynamic where you can filter data as much. This was a perfect opportunity to play around with PowerBI to see if it is possible to replicate some of the reports from YNAB Toolkit. Buckets allows you to export all of your data as a .csv file which can then be imported into PowerBI. A few hours later and I had created a PowerBI report with all the filters I could want.

The above is my PowerBI attempt at the very useful Net Worth analysis screen that is found in YNAB natively and in YNAB Toolkit.

Being able to reflect on past months and see a breakdown of spending by cateogry was a feature of YNAB that I used a lot. With some helper columns and lookups, I've managed to create a version of that using the outputted .csv file from Buckets and PowerBI. I still have some transactions get labelled with a "BLANK" category and have to fixed/add to the lookup helper sheet in the background, but over time, this should become less frequent.

I'm happy with the progress so far, but this isn't a perfect report yet - there's often a time where an error occurs with an uncategorised transaction, but these are easily fixed along the way. Once all the various required DAX formulas were written, and the model joined up for some filters to work correctly, the report is a good replacement for the side of YNAB that I was missing most of all. This best part of doing this is learning & building on PowerBI skills with familiar data and knowing that the end result is something that I really wanted to have. If you've never used PowerBI before, you can download Power BI Desktop completely for free and start trying it out for yourself.

I'll continue building the report out more and see what other features could be added to it and then make a blog post on all the DAX functions & formulas that are needed to recreate it.

Conclusion

Ultimately, it doesn't matter what budgeting software you use and even what type of budgeting methodology is used. The process of being financially aware and taking responsibility for your spending is key to it all. You could even boil it down to: Income > Outgoings. How to go about keeping on that track is down to the individual themselves. This tool (and any other budgeting tool for that matter) is simply a tool to help guide you and offer insight into your finances. It sounds cliché, but the change needs to come from within.

Hammers don’t build houses. People do.

No one says: “look at the beautiful house this hammer built!” Likewise, budgeting tools don’t make you better with money—you do.

Don’t tell anyone I told you this, but you could successfully budget without Buckets. You could use a spreadsheet. Or a calculator and notebook. Prior generations used paper and pencils. Bust out a slide rule or abacus if you want.

Tools are just tools. Effective budgeting is all about you.

- Matt, Buckets