I found YNAB back in June 2020 and it completely changed my financial health for the better. So why am I leaving it?

I've known about YNAB for quite a few years, but I've always thought "Why do I need a piece of software telling me I need a budget?" and "I know what I'm doing with my money!". In June 2020, I decided to revisit the site to reconsider my viewpoint. Throwing caution to the wind, I signed up for the free 30 day trial to give it a run for it's money (and more importantly, my money).

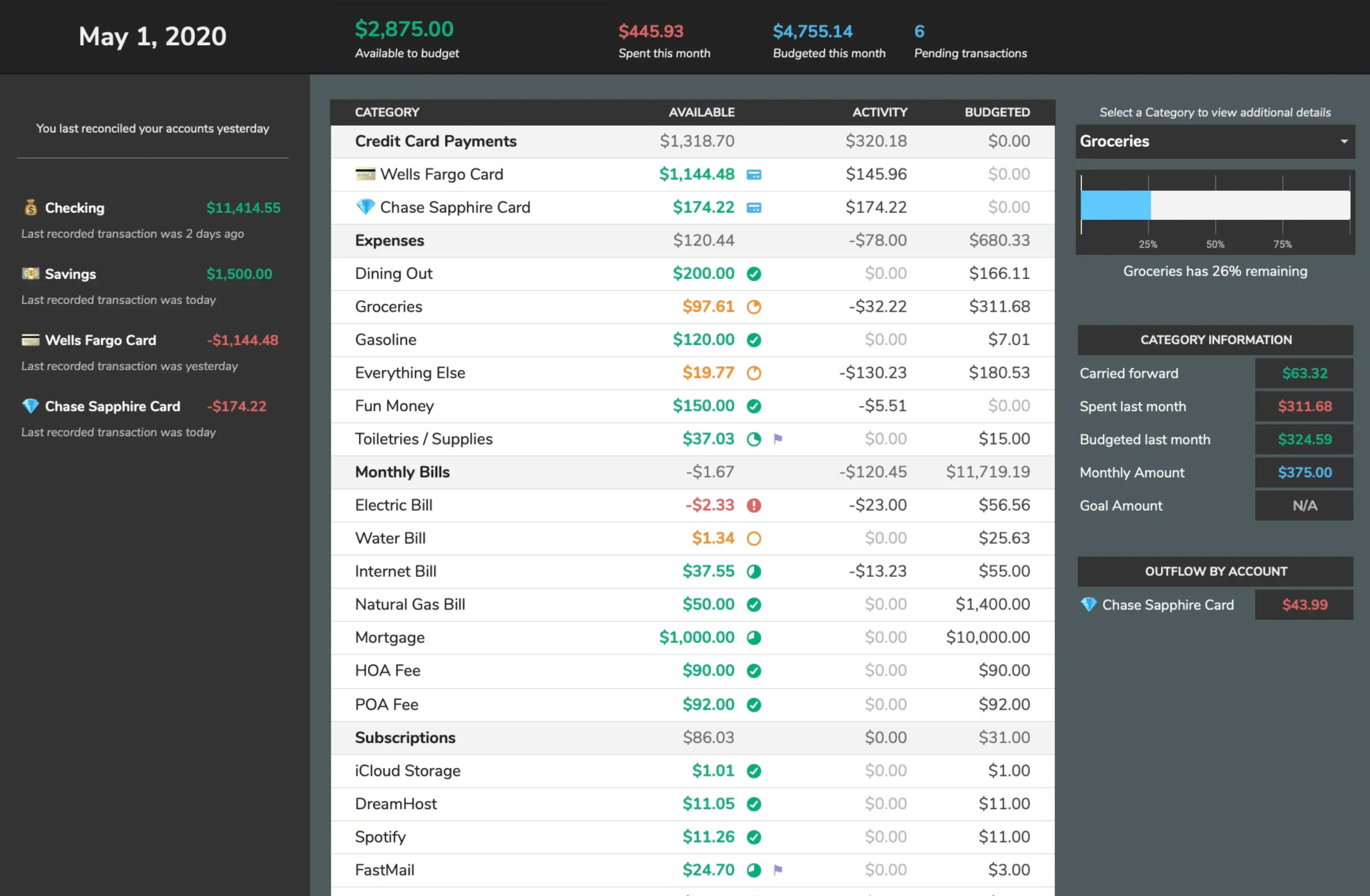

I sat down one evening with Nick True's YouTube channel on one screen and a blank budget in YNAB on the other. (Oh, and if you're new to YNAB too, go check his channel here - it's REALLY useful). After an hour or so, I have all my various accounts set up, budget categories ready to go, and my first month mostly budgeted. This is where my first realisation came - I can't budget the whole month because I haven't got enough money... I'm barely living paycheck to paycheck!?

After many hours down various YouTube rabbit-holes, I have a good understanding of the principles envelope budgeting and want to really see what YNAB can do for me over a longer period so I purchased a year subscription. After watching YNAB's great selection of videos and reading lots of articles explaining their 4 main principles, I find myself getting in to a healthier financial position month after month Now I'm more conscious of not spending money on useless things, I find myself able to budget out complete months and able to store money even for the following month as well as paying down debts. 6 months in and I'm now a month ahead and living on last month's paycheck. I can't even remember the last time I paid credit card interest which was just a normal part of my financial life beforehand.

Fast-forward to the start of November 2021, 18 months of using YNAB almost every day has made it an integral part of my life. My financial position is much healthier and my confidence much stronger. Reflecting on the last 18 months, I now see where the true value of YNAB resides and it goes beyond just the software. YNAB has taught me the process of envelope budgeting, how I should be more sensible with my spending, and has highlighted the requirement to accrue money for large, yearly payments. Beforehand, thing like car insurance would go straight on the credit card and be paid off slowly over a few months, costing me bank interest payments along the way. I think that this is where the true value of YNAB can be found and has become a main reason why I've decided to move away from YNAB.

I have gained so much knowledge of good spending & savings habits, how to better plan large costs, money accruals, how I have to cover money, and get into a a position where credit cards are paid off IN FULL each month and work for ME, rather than the other way around. The thing is, once these fundamentals are learnt, they're not a repeatable item year over year resulting in the personal value I get from YNAB to diminish over time. YNAB cost me £62 for the year, and I easily got £62 of value from it in my first year through what I have learnt.

Cue YNAB jamming in a price increase with no warning...

YNAB has now increased to almost $100 a year which has sparked a lot of debate and outrage throughout the community. I've been watching many threads on reddit with many users annoyed at the way the increase has been handled (including the car crash AMA seen here). Without descending into a long winded journey through my opinions on the price increase, it has made me question and think about the price I pay for YNAB vs. the current value I get from it. I will always be thankful and see my initial investment as a good move but now I view my YNAB subscription as an expensive way to record my spending analysis and make sure I don't over-budget - something that I can easily do much cheaper.

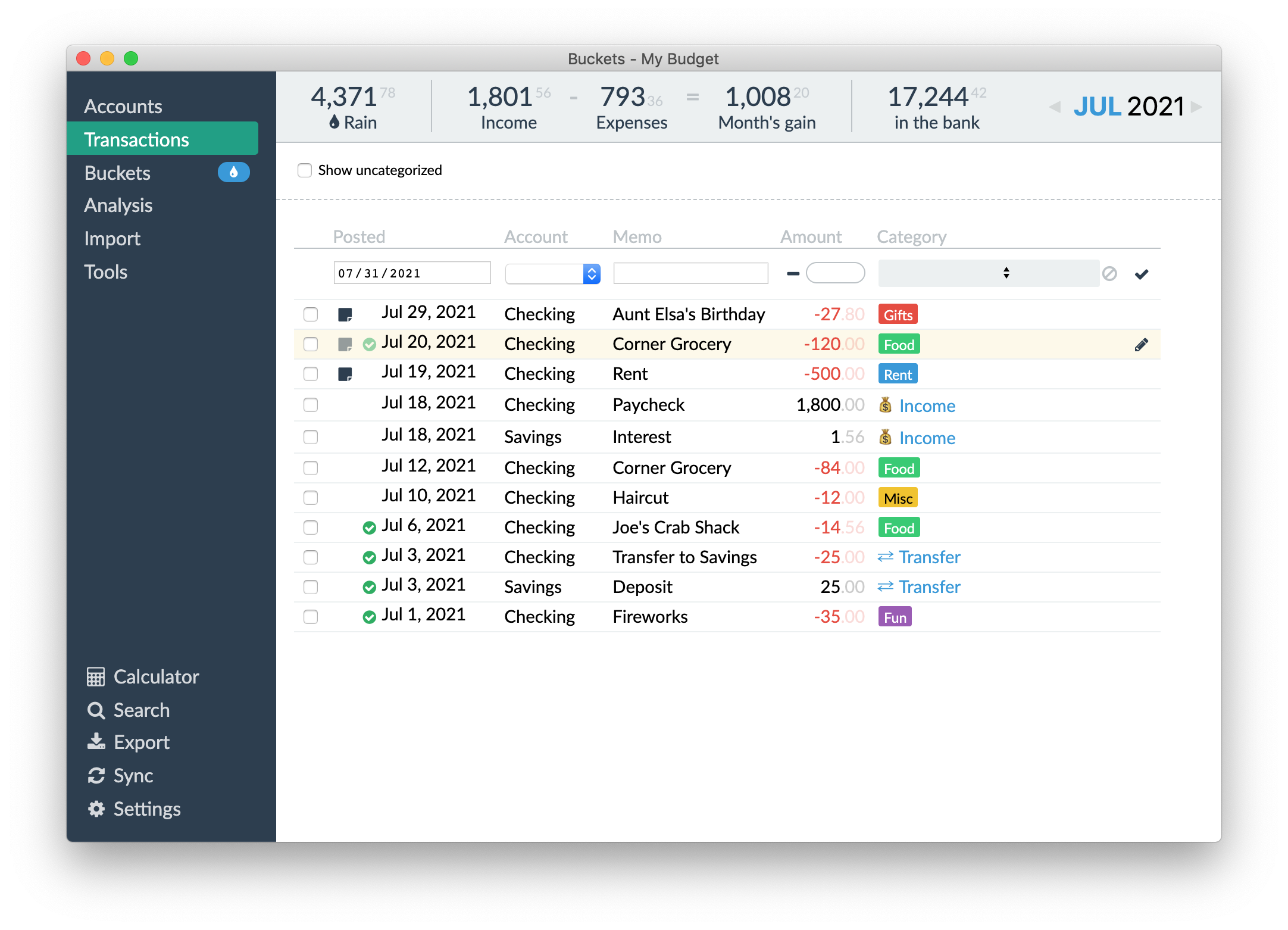

This has kicked me into searching for alternatives to YNAB to see what else is out there for free or at least significantly cheaper. Reddit user u/zikronix created a great list of all alternatives to YNAB which is seen here, and I honed in on Buckets from the list, as well as Aspire (not on the list for some reason).

Aspire is created using Google Sheets and Buckets is created as a standalone program.

Two weeks ago, I started juggling my budget in both Buckets and Aspire and will take a few more weeks to settle on which one I will stick with. My guess is that it will be Buckets and I plan on doing a blog post about it in depth later on. Even in the first two weeks, it has helped me branch my development into PowerBI as I was conscious of losing the historical analysis from YNAB. Again, something I'll delve in to in a future blog post.

For now, I have deleted my YNAB account - and the guys at YNAB have a great feature where they refund you any non-utlised months which is great news. To quote their website, "Don't worry—you'll be automatically refunded for any unused time. Your refund will show up on the card that was originally charged, though it might take up to 10 business days. Part of our Don't Pay for Stuff You Won't Use policy."

So, for now, thanks for everything YNAB. You've taught me so much in the personal finance/budgeting world and have been the main driving force behind getting me out of a rut. You've served your purpose for me, something I am thankful for, but it's time to move on.